One of the relatively hidden concepts in the retail industry of trading is a risk on/off analysis. Or the term i often use “risk profile analysis”.

In professional circles of investing and even mainstream media, the risk on/off approach gets plenty of highlights, but in retail circles, it is a nearly taboo subject. You have more chances of rando-picking next 10X ticker than finding someone in retail who understands the subject.

Many traders who trade SPY and large caps never bother looking into risk on/off or what in particular drives equity markets on a daily basis. This is why so much attention is spent on pivots, levels, and trying to guess what SPY might or might not do, but very few bother studying the underlaying mechanics of what drives the prices of equities. It is very helpful to have a background of the move explained, even if it’s only in hindsight.

All asset classes are linked to each other more or less, and relationships (and competition) is what drives the price moves on each asset class.

This article intends to highlight some of those relationships and what traders or any market participants should be looking for to project moves in markets better.

I believe that partially why this analysis gets a lack of interest, is because many traders are young and it is not within the interest of people to study “boring” markets such as bonds or gold and the impact they might have on equity markets. Additionally, it isn’t the easiest concept to grasp especially when one is younger due to certain “world mechanics” that are part of the risk on/off approach. By “world mechanics” I mean there is a lot that goes into it because those are big asset classes each with a lot of their unique action and functionality.

However luckily, there is a way to condense explanations down to the point where it can be quicker to apply in my view, hence the outline here.

One of key benefits of using and doing risk profile analysis is to not overstay the cycles. To not get bagged. To abandom the ship when the tide is turning clearly. Or at least, to reduce this as much as possible, because we are all still human and flop every now and then.

What does risk-on, or risk-off means in simple terms?

Think about it in terms of flight to safety or move into risk.

For example, when things are good in the economy, people are seeking risk and higher returns. They put their capital into places that are riskier and can yield good rewards. Anything worthy of great reward typically will involve a good amount of risk.

When things in the economy get worse (recessions) people become risk-defensive. They might pull money from risky projects and park it in their bank accounts until the situation improves.

It is the same way money flows in markets and how institutions think on a daily basis. The only difference between you as a consumer and an institutional investor is that a typical consumer makes risk on/off moves only once or a few times a year. Meanwhile, institutional investors do those re-positionings constantly on a daily or weekly basis. Which explains constant push-pull dynamics in markets. Big money is not static. And those that are eventually get flushed out in major cycle changes.

Risk ON: The market seeks riskier assets that have higher % return potentials. Typically within equity space or emerging market currencies or other exotic instruments (small-caps).

Risk OFF: The market seeks safer assets that have low % return potentials but at least do not have significant risk behind them. Because if the situation “out there” is problematic, one isn’t looking for returns, but just to keep what they have.

Or to use another analogy from poker which many might be closer to:

Risk ON is when you are participating (not folding) and adding bets because your cards are good and opponents are judged to be either a match or weaker.

Risk OFF is when one folds because the cards are not optimal and it is likely opponents holds a better hand. When you fold, you go back to the cash position sort of speak.

Typical asset responses

Let us briefly cover key relationship dynamics. Those are typical reactions of each asset class depending if risk ON or risk OFF is in play. We start with these basics and then build on top with bias.

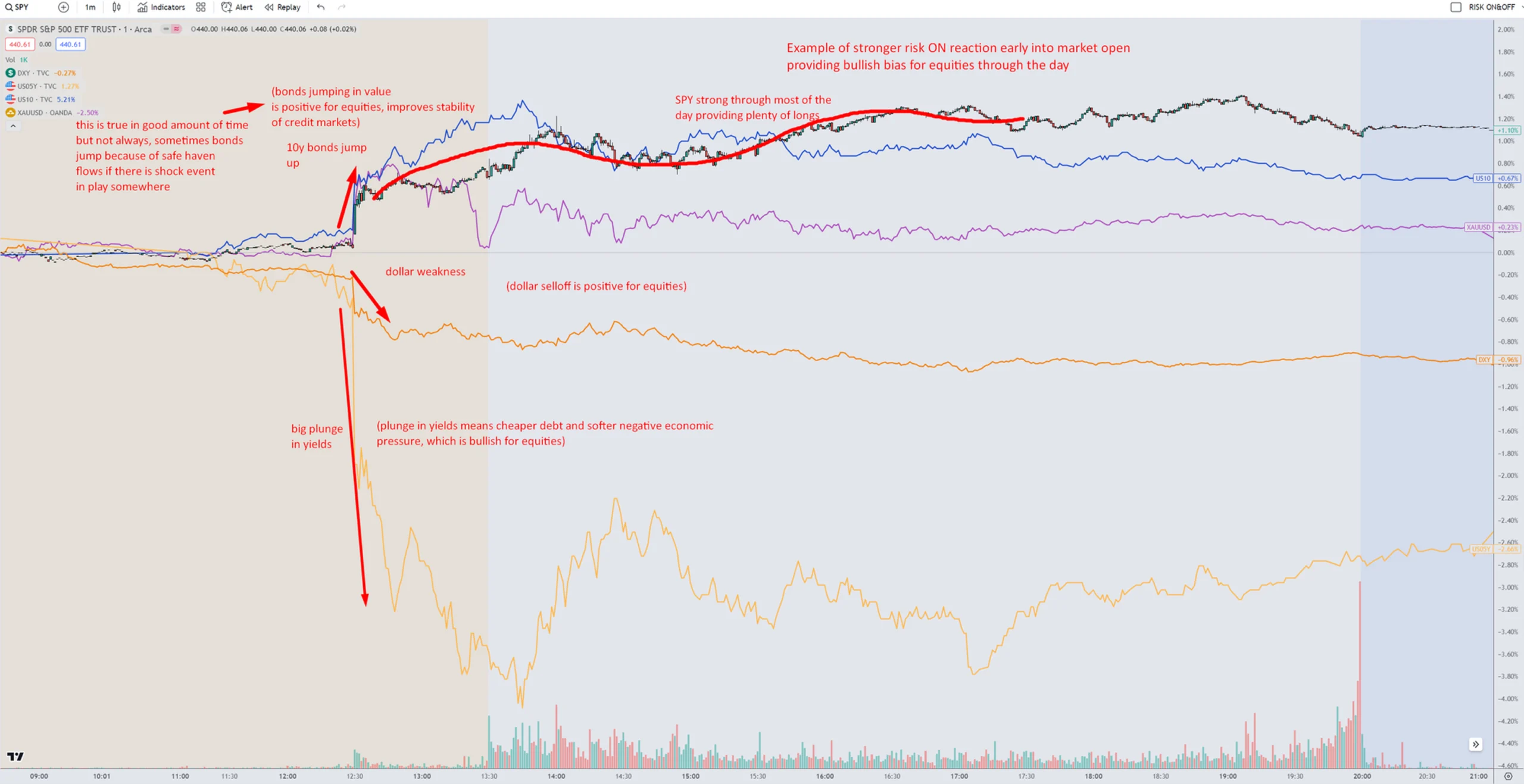

Risk ON:

-SPY and equities higher

-bonds (TLTs) higher

-dollar lower

-bond yields lower

Risk OFF:

-SPY and equities lower

-bonds (TLTs) lower

-dollar higher

-bond yields higher

Gold and crude oil are not included in the above analysis, because their reactions to risk on/off are much less stable, they have more variations. It requires more in-depth explanation to get this point across so let’s leave them out for now.

For example, sometimes when risk-on ignites gold will perform well, because of how strongly the dollar has droped (which we can see in November). But sometimes risk-on is present while the dollar is flat or somewhat strong which can make gold struggle (stay inside of range).

This can create more confusing input into the analysis and requires more experience on the macro side to interpret the input. The same goes for crude oil.

Economy, news and risk ON/OFF correlation

From economic-functionality perspective:

RISK OFF:

When things worsen in the economy (per news and data releases), the fund managers might be more eager to sell the equities. So they start to liquidate SPY or other large-cap positions. Leading to the decline of that asset class.

At the same time due to worsening (catalyst) present in the economy, they might also sell some bonds, which leads to bond yields going higher (yield is seeking bidders at higher prices).

At the same time, some of those participants might move their liquidated cash position into an actual cash position by converting or buying the USD. This leads to USD strengthening in such situations of worsening economic performance and therefore a risk-off reaction. When asset managers and market participants become defensive due to worsening conditions, they might move some portion of portfolio into cash and create bid on USD. Altough the bid on currency comes from multiple other sources at same time, for sake of simplicity lets keep it with only explanation above.

RISK ON:

When things improve in the economy (per news and data releases), As new positive catalysts that shows economic improvement hits the market, the market might be more eager to bid on SPY and equities in general. When things are going well many market participants start to seek risk and higher returns (because overall risk has decreased due to improving conditions). This leads to SPY moving higher often in such cases.

At the same time, bonds might also get bought from institutional investors which pushes yields on bonds lower. Improving economic conditions means that countries can borrow money at cheaper rates, leading to yields declining.

At the same time dollar might get sold off, because people and money managers are less interested in holding cash positions (being defensive) and instead go into offensive mode seeking risk. Seeking risk means exiting a cash position, and putting cash inside a risk pool (buying equities, crypto, real estate, and what not).

This is very roughly the basics of the relationship between those assets.

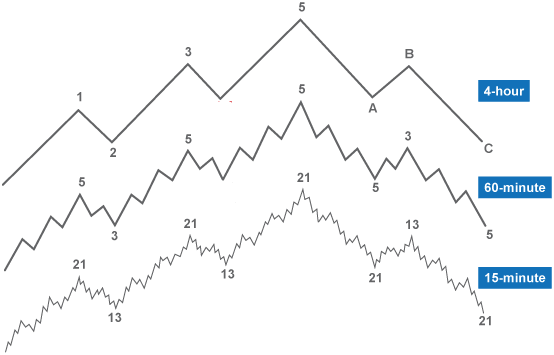

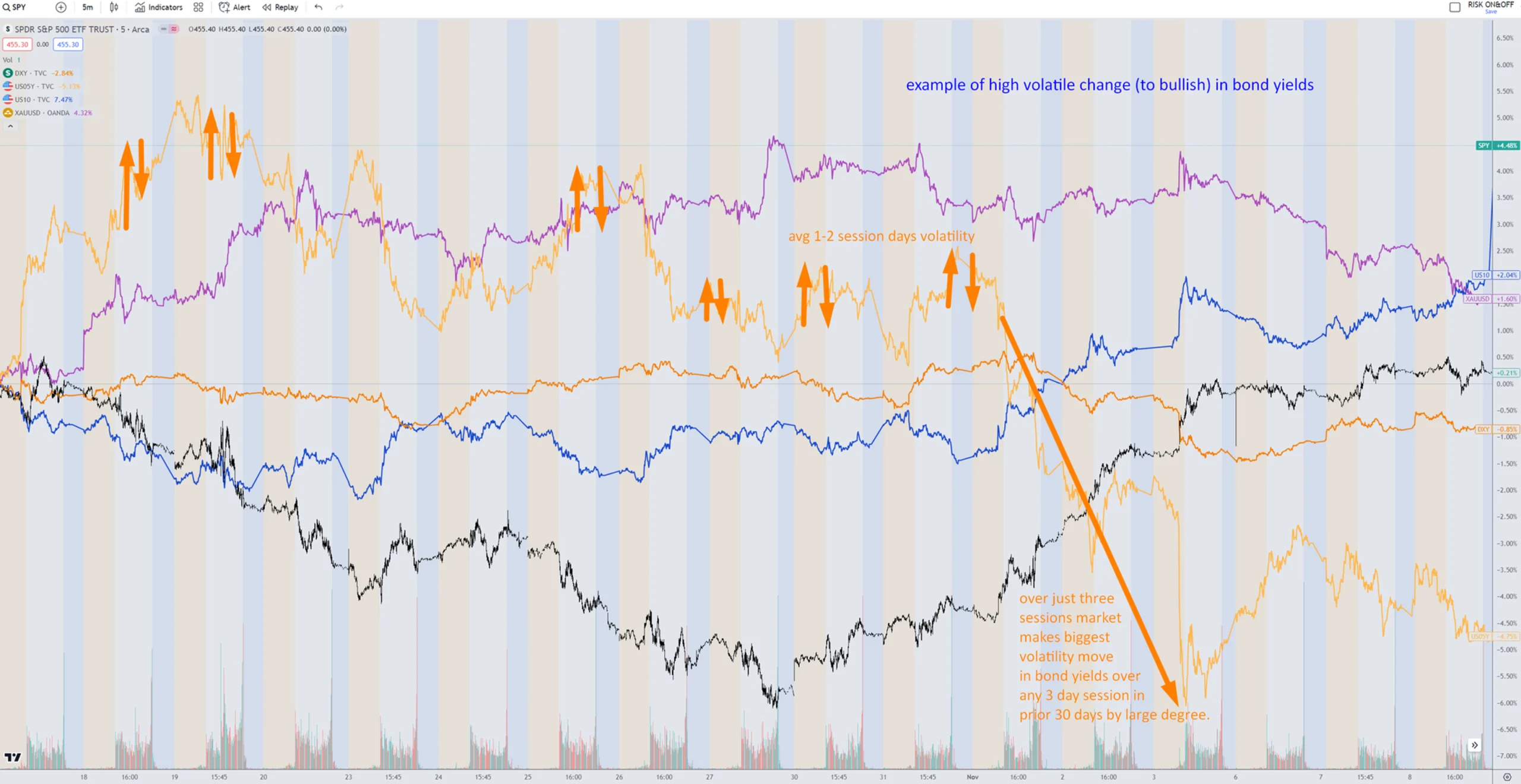

Multi time frame analysis

One should always use two-time frames to do the risk on/off analysis. Using just a single time frame can quickly remove the context, especially on more quiet and neutral days. It can also create too much whip-saw bias shifting if one is only looking at the broad market flows from a single time frame. It’s always much more stabilizing to have two different time scales in mind, to see how lower time frames should match the higher time frame.

Personally, I use 1-minute charts combined with 15-minute charts to do a split analysis on each and to see how 1 minute fits into the bigger picture of a 15-minute analysis. The idea is to establish two trend dynamics:

-bigger picture money flows currently present (15 minutes)

-smaller short-term picture money flows currently present (1 minute)

And then combining both, especially on neutral days. What is meant by that, is that when on a short time frame there is strong ignition either on the positive or negative side, multiple time frame analysis is not as important. Because catalyst ignitions (which usually cause that) can actually change big-picture money flows from a short-term perspective. What is meant by that for conceptual example: -15 minute trend is in risk-on for past 10 days

-1 minute changes trend direction quickly and sharply on news catalyst into risk-off

-this then leads to trend change that lasts for 5 days (changes higher time frame). It started on short time frame ignition/reversal. This is why tracking short time frame changes matters every now and then.

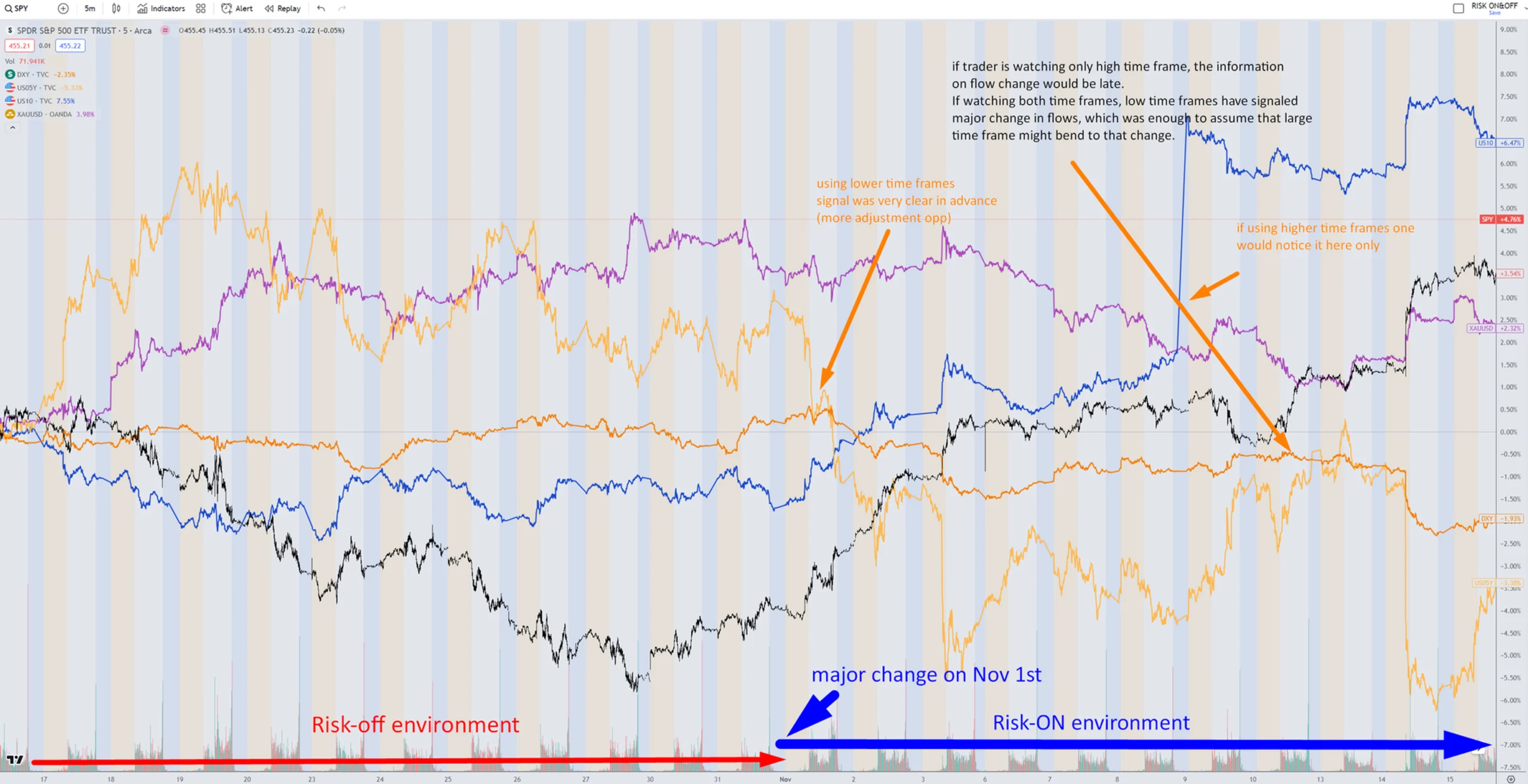

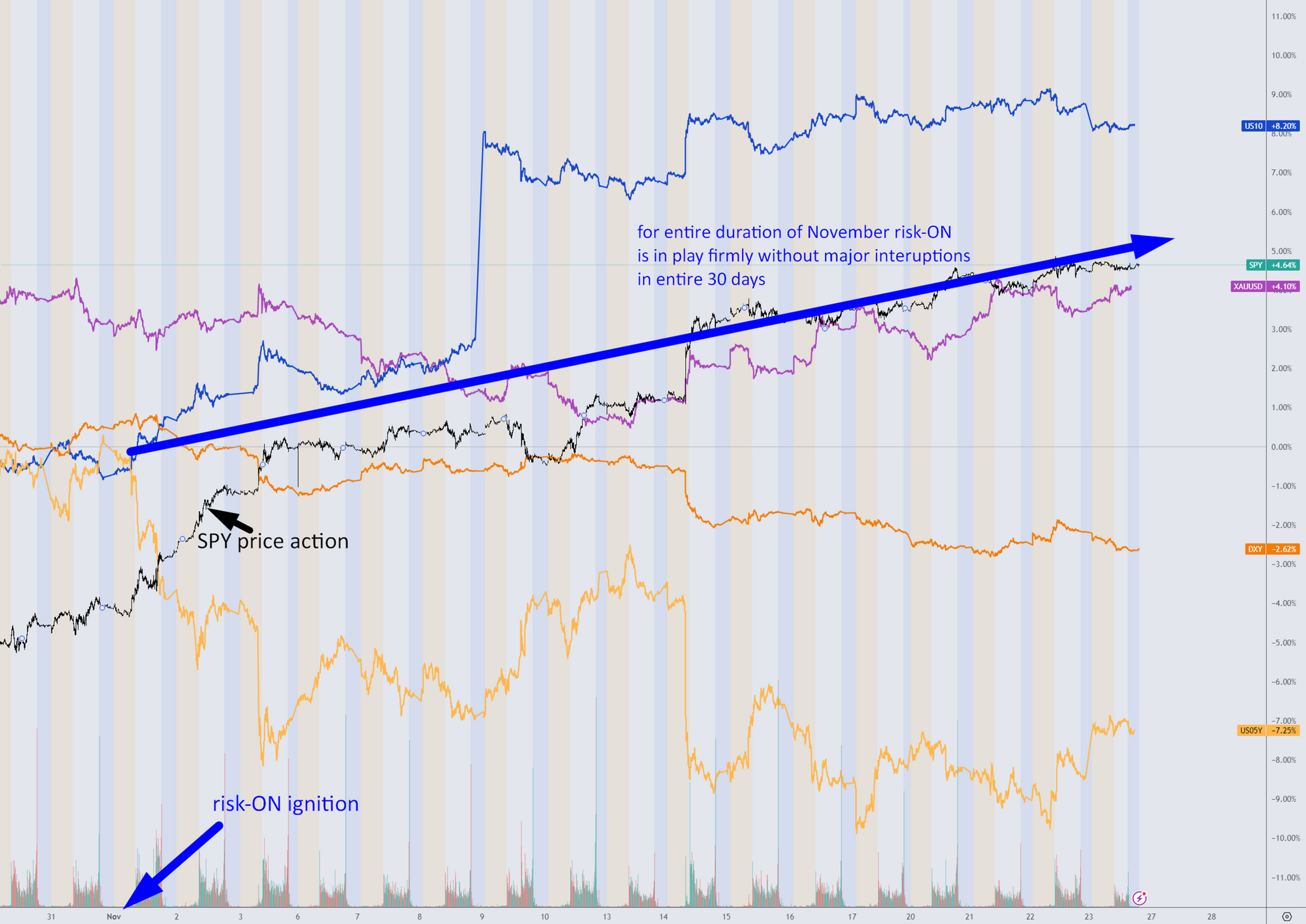

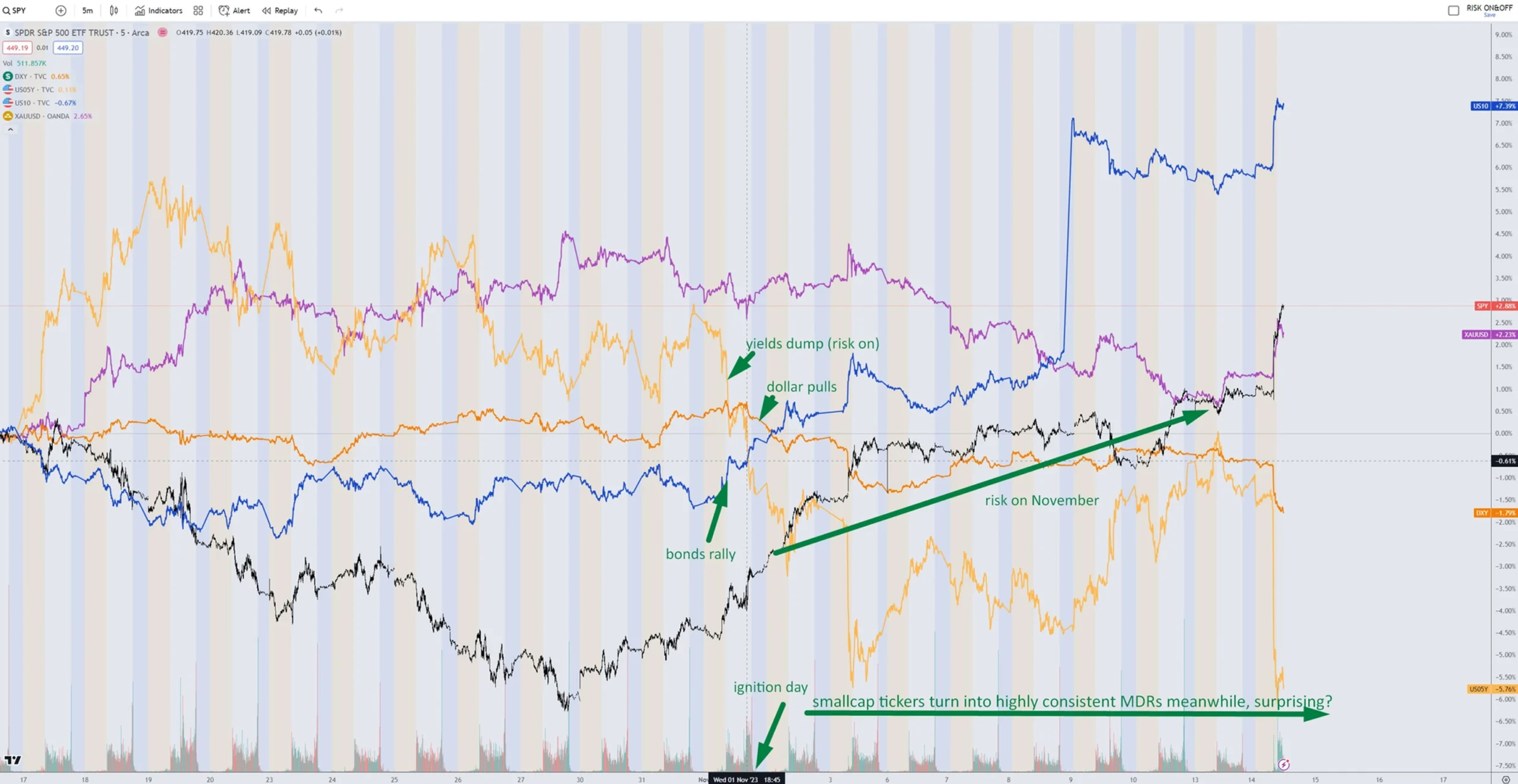

To put above conceptual example into practical example we can use November 1st risk-ON ignition. We had for 3 weeks of October semi risk-off environment (Mid-East conflict as main cause of that), which then was reversed intraday on November 1st. And that trend reversal lasted for nearly the entire month of November. The point is, if one is only tracking higher time frames, you would not recognize that change until all the way into the middle of the month of November. You would have missed almost 10 days of hot action because of not implementing both time frames at once.

The conclusion is, that low time frames bend to high time frames if we have more neutral-ish days intraday (on low TFs). Higher time frame flows will generally “scoop up” the smaller time frame deviations and turn them towards the flows of high time frames.

However: When low time frames have strong surprise catalyst that can cause flows to not shift just a little bit but instead significantly, as we have seen above on November 1st. Significant tilt on short time frames can then start to chip away at high time frame flows and turn those flows completely. This is why both time frames need to be used.

Double TF use counts the most on neutral days instead. For example, when 1 minute is relatively flat and no asset prices are moving anywhere much (gold flat, equities flat, dollar flat), on a day like that, it is very helpful to have in mind big picture context (15-minute time frame) to see what is to expect from the day like that. And which direction one should stay with. For example, if 15 minutes suggests that the market has been in risk-ON mode for the last 2 weeks, and the current 1-minute short-term TF is flat, this should give is slightly more bias towards further bullish expectations.

To put some combinations forward (roughly speaking): -15 min TF risk-ON + 1 min TF risk-ON = risk-ON with high score. -15 min TF risk-ON + 1 min TF neutral (flat) = risk-ON with lower score

-15 min TF risk-ON + 1 min TF risk-OFF ignition = neutral or risk-OFF (if flows kick in hard)

Those scoring variations allow us to structure better plan each day and what to expect out of tickers, rather than forcing same expectations every day, its better to follow institutional money flows and adjust based on how risk proned “the money” is at that moment. No matter what ticker you trade, it will be impacted by risk on/off profile of broad markets. No asset is excluded. Including the anarcho-capital exotic island of crypto markets. In fact crypto even more, because Bitcoin has very high sensitivity to global liquidity, more than many other asset clases.

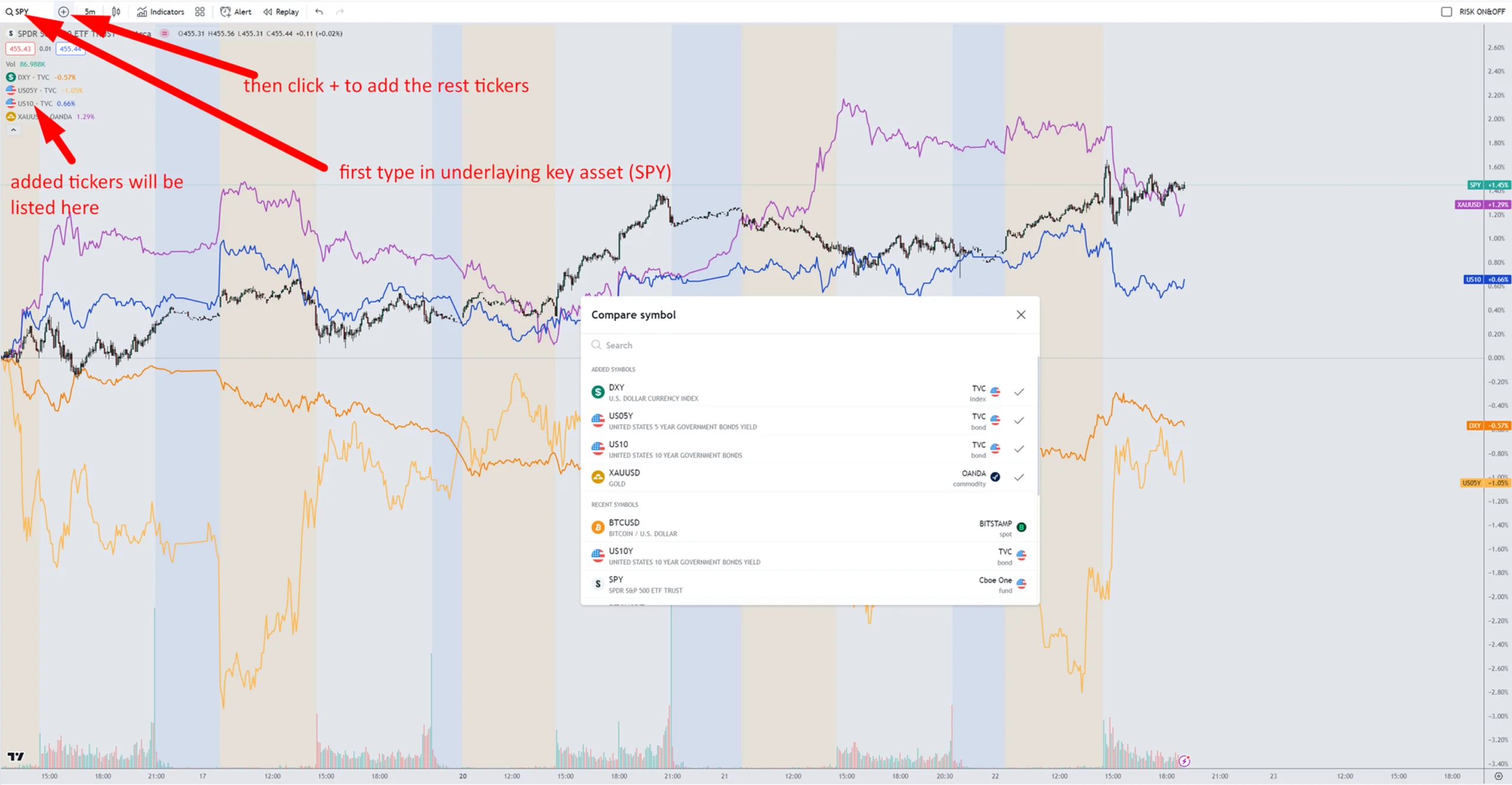

Tradingview chart setup

For anyone interested in using a similar visual setup to the one shown in the image examples here, feel free to use Tradingview and overlay all the assets in a single chart window.

It is more practical than having 5 separate chart windows open to see all the assets as relationships and divergences are not as clear to see that way. There are perhaps other charting platforms and you can replicate the setup similarly. There is no promotional aspect for Tradingview whatsoever, it is just that they offer biggest pool of assets and have very flexible charts for this particular task (overlaying tickers/assets), i have tested multiple other platforms which often fall short in one or many other areas.

The assets listed (attached) on the chart should be:

-SPY (SP500 as key equity index)

-US10Y (US 10 year bonds – TLTs)

-US05Y yields (yield on 5 year bonds)

-gold (XAUUSD or GLD or other tickers)

-Crude oil (optional)

-Dollar index (key currency index)

-VIX (optional)

The reason why crude oil is “optional” is because the impact on risk on/off from crude oil is often limited and confusing. While many would recommend adding commodity prices for risk on/off analysis (as they show the strength of demand within the economy) and crude oil is underlying for many commodities (due to the energy needed to extract them), the problem is lack of clarity in many situations, especially for non-seasoned market observers. At least from my observations. For seasoned market participants, it’s perhaps more useful, and for someone less (for which this article is made) its perhaps better to avoid using it, at least initially. Anyway, just a quick explanation on why crude oil is not used on my charts. That doesnt mean oil shouldnt be part of risk on/off analysis, it just means it is bit more confusing and difficult to interpret its impact on daily basis. Might work for certain eye and might not for many others.

The reason why VIX is listed as “optional” is because it does not overlay with those assets well. Its volatility ratio is much bigger, and it skews the chart of everything else if it is added in same window (not sure if this applies to all platforms). I think that VIX should be part of risk on/off analysis but use it in separate charting window as i do as well.

Each asset should have a unique color and be represented with a line chart. Candlestick charts are always superior to line charts no matter what, however sometimes one cannot use them for practical reasons. Overlaying all of those assets with candlestick charts can make it harder to read and more confusing, which is why using the setup as outlined might be a better idea. The only ticker on the chart with actual candlestick action is SPY as you can see, and that is optional, it is not required.

To overlay assets in Tradingview in such manner, first select core asset and then click on plus to add all the rest assets into same window:

Relationships between key assets

Risk on/off analysis is mostly about the relationships between key (few) global assets and how their movements impact other assets within completely different asset class groups. For example, the impact of a gold price rally on stock prices, the impact of bond yields spiking on an equity index, the impact of a falling dollar on stock prices, etc…This is technique that most instituational participants are thought first. This is technique that most retailers either never look at, or do very very late into their journey (5 years plus).

This article focuses on the resulting relationship outcome from the perspective of equity markets, or specifically SPY itself. This is to simplify things and to make it more practical. But in the end, those relationships are not about equities themselves. One could take an approach in either direction. For example, how does a strong dollar impact bonds, how do weak bonds impact stocks, how do strong stocks impact gold, etc? There are many variations depending on what asset one wants to find the resolution clue about. But as said, the focus of this article is specifically on equity prices as in my estimation that is what most traders are interested in (and so does core of my daily activity in markets).

The first thing we should establish is that markets are a constant flow of money back and forth. From one asset class to another, and then back again at some point. It’s a never-ending reshuffling of capital into the asset categories that make the most sense to be exposed to at a particular moment, from the eyes of market participants, but mostly the institutional investors or market making firms since those are the ones that ignite and move the asset prices the most.

Risk on/off analysis therefore is where one is looking at where the institutions are currently pushing capital into, or where they are pulling the capital out from. Into somewhere out of somewhere.

The relationship dynamic is the core of such analysis. I should point straight away, that the point of this article is to summarize and put the method in practical implementation for those without significant research or market experience. However, that includes not covering all the basics of key asset classes that one needs to understand before this analysis starts to make sense.

This means that for anyone taking this seriously, you should take some dive and research basics around each asset class (equities, dollar, gold, bonds, etc) because without covering foundations it will be harder to interpret the moves on a daily basis. If you are serious about it, make sure you take a month and do some research into each asset class. The reason why this should be highlighted is that I know how asset-focused (asset racist is that a term?) many traders are. For risk on/off you must spread the wings and be open-minded and curious to check all of those places out.

Stop guessing whats moving the market and look at money flows of risk-on/off profile

Combining the market outlook through key asset classes always leads to more clues, rather than trying to make sense of one market class through the lens of that (and only that) asset class (which is always leaving you with blind spots). Why is SPY rallying? It has to be because crazy algos are buying it. This would be a common rationale of single-asset-focused traders. If you look and zoom out enough you might notice the dollar has weakened, and that market is bidding on many riskier assets at once while exiting cash positions or exiting safer assets (bonds, dollar, etc). And often that will leave a much better clue than guessing with strange assumptions about “irrational algos”. Most “crazy” assumptions are typically those who never bother seeking for proper in-depth explanations.

As mentioned earlier in the article, one of the main reasons why so few traders apply this to their trading (which is highly useful to have explanations on why the moves in markets happen the way they do) is because they have only an interest in a single asset niche. Risk on/off is the inverse of that and requires one to venture with interest and curiosity into multiple assets.

That does NOT mean one is trading all of those assets to be completely clear, it means that one studies and researches them so that relationship dynamics are clear. Even if one is only trading SPY or large caps, it is very useful to know that today might not be the day to go long, based on how the risk on/off flows are positioned. And extract any of the suggestions made for SPY trading to be the same as for large caps, because this is all about the trickle-down effect of markets:

-bonds-currency-equity index-large cap stocks-smallcap stocks.

It starts with bonds, and it ends with small caps. The entire chain of assets as you see them listed above influences one another, and the money flows that institutional capital is shifting from one place to another based on changed daily dynamics of markets.

-Do you have a geopolitical escalation in the Middle East? Pull capital from smallcap and low-tier large caps and push it into bonds or currency.

-Do you have a central bank announcing new QE and lowering interest rates? Pull capital from currency and push it into large caps and then small caps stocks.

That is very roughly how institutions reposition based on changed daily dynamics, using two opposite examples. First one risk-off, second one risk-on.

If there is complete correlation, what is the usecase of such method?

Someone might say, but if the dollar goes down which causes SPY to go higher, isn’t this an inverse relationship, and if such a relationship is highly correlated, meaning that instantly as the dollar plunges the SPY responds with exactly the inverse move of that…what is the use case then? Keep in mind, that 100% correlations with the same timing are not useful in markets because one asset is telling you the same story as the other asset, even if they are inverse of each other. Luckily that is not the entire story, so let’s break it down how one should think about it.

Think of it as a supportive, or unsupportive environment for stocks. Are we currently in an environment that is supportive of higher prices in equities? Or not?

But don’t think about it only in terms of correlation, think also about the long term DRAG effect. What is meant by that, is if the dollar is trending higher consistently day by day, that is not a very supportive environment for stocks. This means that it is possible the equities will struggle to make new highs or might be declining if dollar keeps ramping higher. Sometimes, equities will go higher when the USD goes higher at the same time. But the DRAG effect of the strong dollar will eventually top out equities and send them lower. This is a drag effect, which is not necessarily 1:1 on inverse correlation. So always look from the perspective of a supportive or unsupportive environment, because that can lead to more realistic targets on where the equities should go next over mid-term perspective.

Let us outline this in conceptual example:

Risk on/off analysis is NOT static (be adaptive)

If we lean on the point above, why should one think about the “constant flow of money” in markets? Because risk on/off analysis should not be used as a static method. It is highly dynamic, which requires constant adaptation and 0 “set and forget” bias.

The flows can change at any time. They can change in opposite directions completely, and sometimes when they do, the asset classes will begin trending for weeks in that newly established direction. This means that it is incompatible with thinking about this approach in static terms. Mostly it’s because of duration exposure differences.

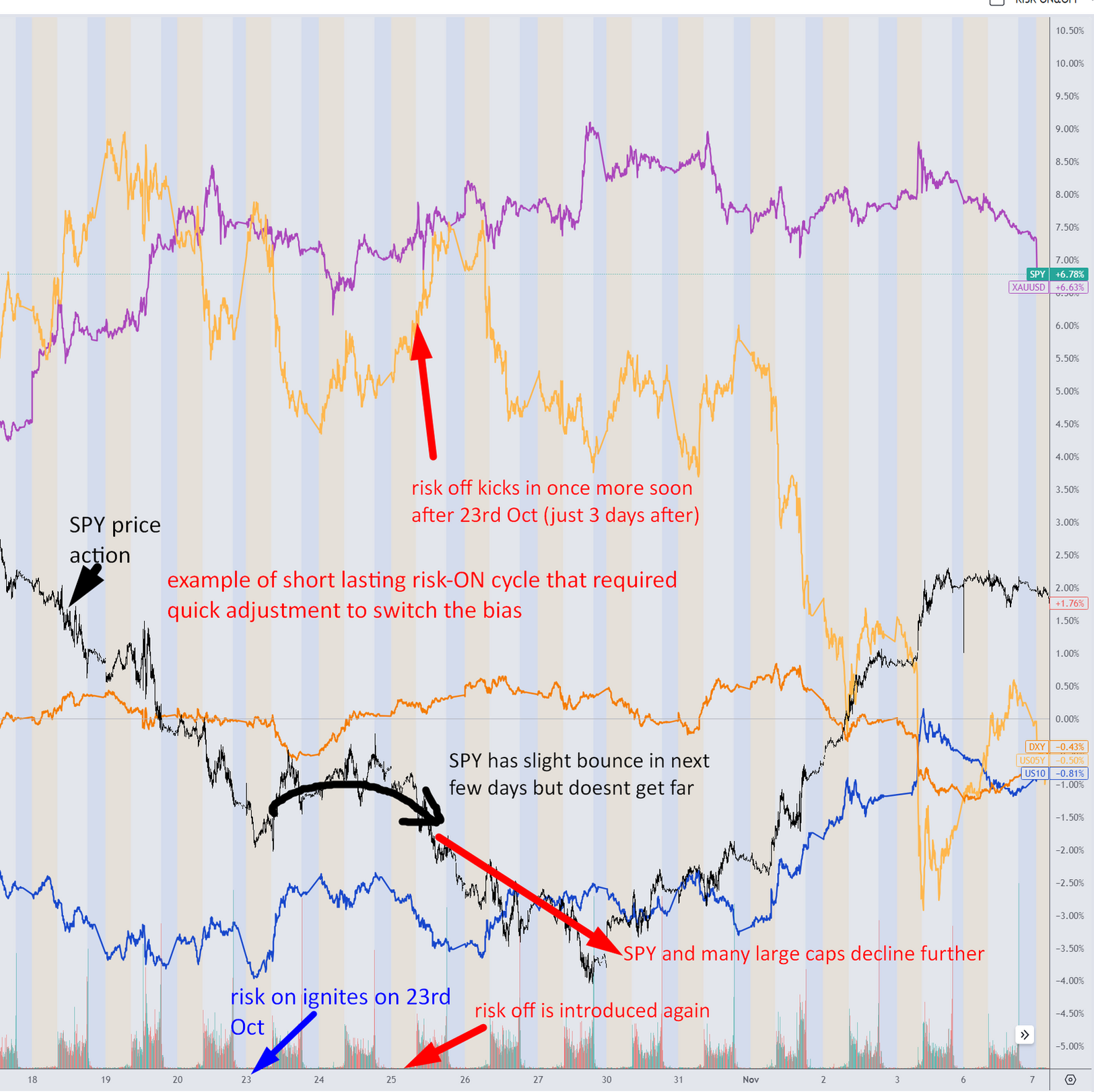

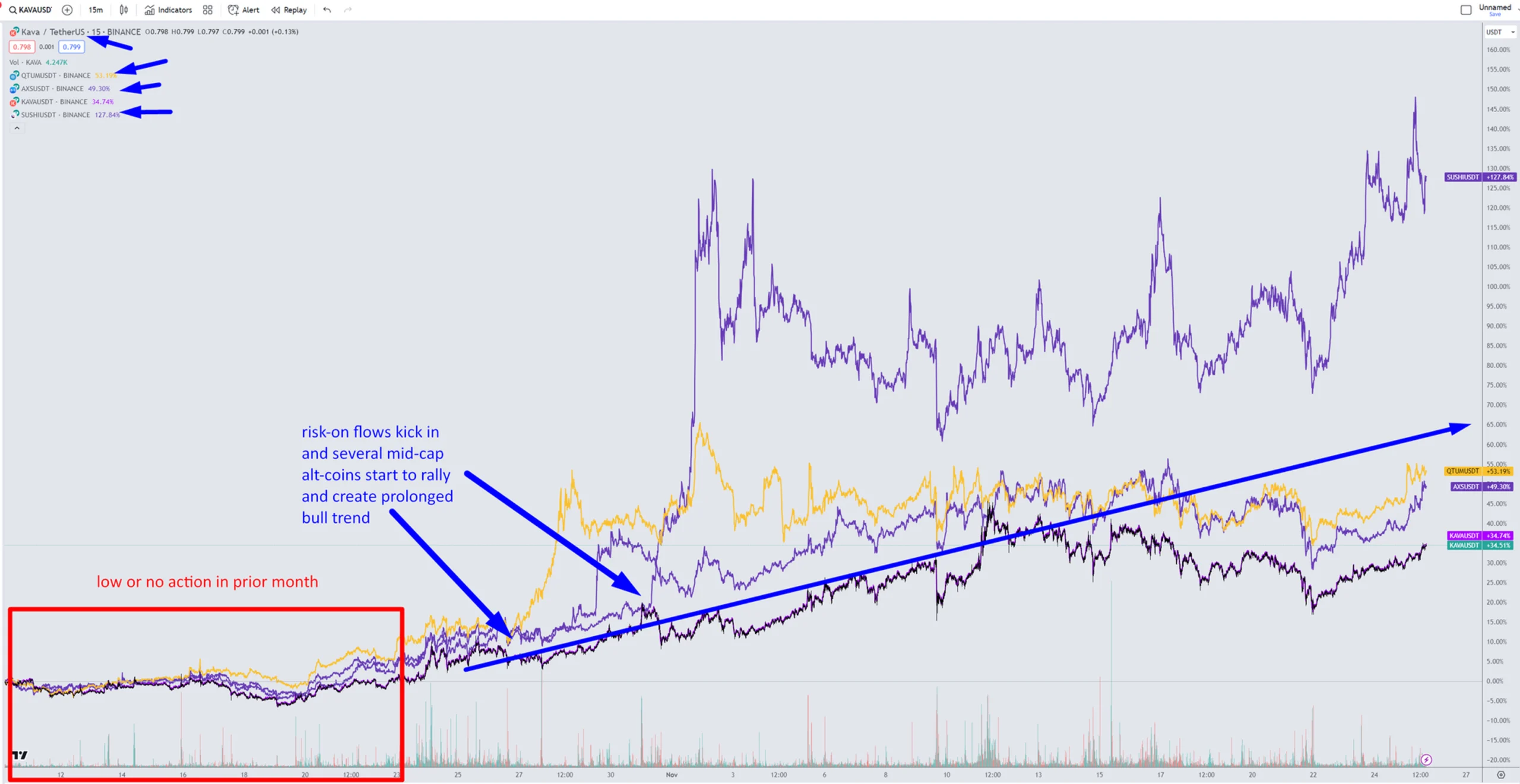

For example, sometimes risk-on kicks in and lasts for 3 weeks. Which gives one smooth trend to follow (to trade large caps on long side for example). In other cases, it only lasts for a few days before risk-off kicks in again and inverses the flows. Because of these different durations of how long those risk on/off cycles last (with significant differences in days of durations) one HAS to be dynamic about adjustments. This brings us to the point above on why using two-time frames to establish bias as well.

Different lengths in cycle durations

So the point about being dynamic with method is that sometimes the cycle lasts 3 days. And sometimes for 30 days. There is a big differentiation in exposure length between 3 and 30, which requires us to expect any duration. Hence, being sensitive to short-term changes is ideal, because one doesn’t know if this newly established cycle is going to last shortly (and require one to adjust again with new bias) or if it will establish a long-lasting cycle (which makes for a good trend-extraction plays without worrying about short term changes too much). It could be either or, and you don’t know which one exactly the market has for you upcoming.

By static analysis, I mean for example that some traders make an analysis one month in advance for a particular stock and then they stick to that and make trading plans around it. In risk on/off no plan should ever be considered a long-term (1 month) plan in advance unless one knows well what they are doing. It is healthier to be as adaptive as possible and adjust to the flow changes daily. Not weekly, not monthly, but daily, or perhaps even hourly. That ensures the lowest chances of getting bagged and overstaying positions. Do you know why so many traders get bagged on top of cycles? Because they do not pay attention to changed dynamics of risk on/off sentiment. Overstaying is likely if you don’t pay attention to this.

Example on image below is very short lasting risk-on cycle. Those cycles happen from time to time. It is falacy to believe that each time new risk-on/off cycle ignites that it has to last for month or two. In more than half of the cases it ends much sooner.

And to have counter-punch to above example, below is the longer lasting risk-on cycle example:

The above two examples should give you a firm conclusion on why adaptation to those flows is required and why being nimble on a daily basis is a good thing.

Keep in mind however also a statistical factor that:

-It is not highly likely that within the single intraday session flows would go strongly from risk-off to risk-on.

-It is also not very likely that on any random day, you would see flows shifting from risk-off to risk-on without the support of a major catalyst.

This means that IF flows were to inverse strongly it’s highly likely it happens on the day of some major catalyst. CPI report, FOMC meeting, central bank monetary policy changes, and similar high-impact economic news.

Should one pay attention to news and how the market reacts to it? Of course. Again, it’s not that your interpretation of news that matters. It’s market interpretation and money flow, and what it does to potentially change risk on/off sentiment. Your task is not to question the market’s reaction (which is what many pundits in markets do), as a trader your task is to follow the newly established direction of money flows until it lasts.

Before you question the flows, trust them.

Remember that academics can afford to always be skeptical and doubt every move of a market. As a practictioner trader or investor you cannot operate like that. So before you question things, trust the flow. Questioning the flows is actually a very advanced concept and it takes a significantly experienced person to do it well (most that question it will get on the wrong side of the market for a prolonged period of time, which as a trader you cannot afford).

How often to check on the flows?

My approach is to do 3 checks across each day and re-assessing the flows. One in pre-market, one around market open, and another one in the middle of the day. Sometimes that schedule changes if there is an important news catalyst, but typically that routine stays the same. You don’t have to spend much time on that, once you are familiar with the concept. It takes a small amount of daily input on track, and the return on understanding where money flows are going on a daily basis has significant advantages no matter what asset class one is trading. Low time consumption (except the time invested into learning about the method), and high-value output for bais formation. On a typical day, it takes about 5 minutes in total to asses the flows.

Dont try to interpret the news (unless you know what you are doing well), interpret the money flows instead

Many times in markets it’s difficult to figure out what the catalyst means and whether the market should take it as positive or negative. Many times what seems to be a positive catalyst ends up being a negative reaction in markets, for many reasons.

Risk on/off analysis can help the trader to figure out not what the interpretation of catalyst is, but to figure out what the market (mostly institutions) is doing with their capital on the release of catalyst. Are they bidding on it or selling it. This makes it much more practical for traders to figure out what the key market participants (biggest ones) think and which direction might be the one to play in. Not using risk on/off around key news events is definitely trading with at least a third of the less open-eyed vision that one needs in markets.

For example, it is very common that on FED minutes traders try to read every article or read every comment from the FED chairman and try to interpret what this should mean for market direction next.

Only few (retail participants) check all key assets (USD, SPY, gold, bonds…) to make up the view of how the biggest market participants interpreted the news. Which is the most important thing. Your interpretation of the catalyst is always lesser than one of the biggest market participants (those that shape risk on/off flows in ignition phases). So traders and investors spend way too much time on interpretations of catalysts and too little on interpreting market action and how they bind to risk on/off. This leads to subjective opinions at too high a rate. Money flow interpretations are far more strict and direct with less subjectivity. Which is exactly what you want as a market participant.

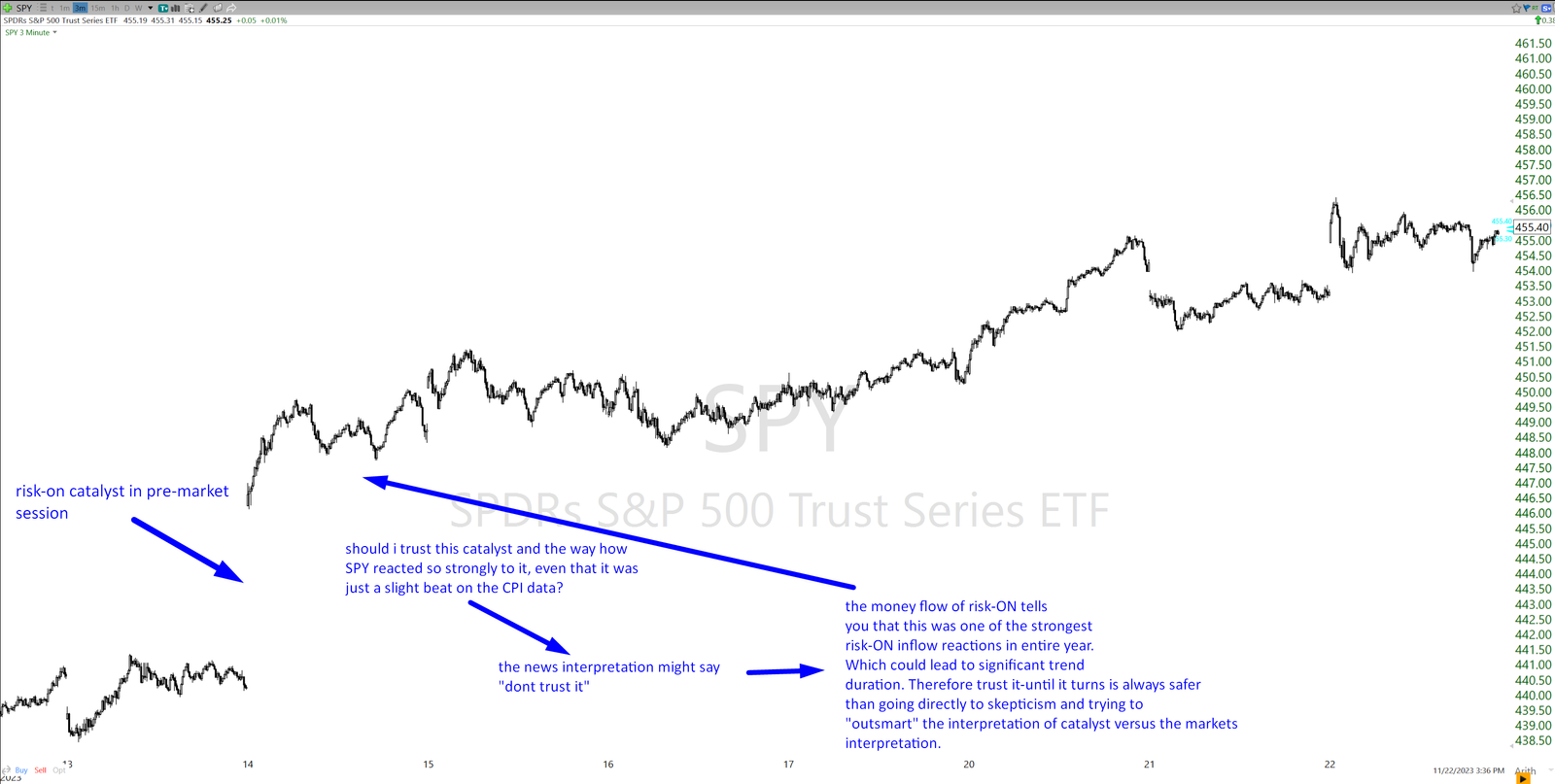

To validate point above lets use an example of US CPI news release on November 14th:

As we can see, the market reaction was significant to the catalyst, even though on face value catalyst is very weak? Slightly positive because the inflation came lower than expected, which in the era of elevated inflation is good news. However, it was only a slight beat over the expectations.

One might assume that this type of news can only deliver a very soft and small positive reaction. Yet it was completely the opposite. This catalyst delivered the strongest risk-on reaction in almost an entire year.

Now think about it, have there been much more bullish catalysts over the year of 2023 that would justify more such move as we got on November the 14th? Sure. A few if not more. But that is not the point.

Trust the money flows first (if you are trading markets on a short term basis) before you start to question the validity of news. This especially is true for anyone trading short term, which assumes most of readers will be. As one can see from the chart above of SPY, market went into significant risk-on mode with solid uptrend on equities.

Risk ON/OFF analysis is how one survives in markets. Experienced market participants still get in trouble because of not understand the risk profile analysis (once their favorable market conditions shift).

Typically traders who are ignoring this concept in markets and are fully single asset-focused will eventually land in a market where for 2,3 or more years market becomes dominated by major changes in risk on/off flows. And when it starts to happen it usually takes long time for people to figure out whats going on, mainly because of lack of understanding on risk-profile analysis (and because they are so much single-asset focused).

Especially small-caps equities and crypto fellas tend to fit that the most. If I am a crypto anarcho-capitalist or smallcap moon pumper surely I don’t have to pay attention to risk on/off flows? Well turns out you do have to. The amount and quality of opportunities are highly correlated to global market liquidity. And global market liquidity is derived and ignited from risk on/off changes!

To put it this way using two different years:

-2020: The amount of high-quality long opportunities in both small-caps and crypto was highly correlated to the major risk-on flows ignition in late 2020. If you ever wonder why there was such a rush in both of those markets that year, it is due to that.

-2022: The situation was upside down. Risk-off began and the number of quality opportunities shrank significantly, making it more difficult for everyone.

In each case, risk-on/off ignitions were noticeable early if one knew what to track. So this isn’t about hindsight analysis. We don’t need to go beyond those two years as clear pro-contra examples of just how important this is.

Both years outlined in high time frame risk on/off assesment:

Dont half-ass risk profile analysis just by watching SPY (highly common and sloppy)

If you only watch SPY and nothing but SPY (besides a bunch of large caps that you might trade), then how do you explain yourself when SPY just rallied 5% in a short amount of time, without looking at the whole capital redistribution game of risk on/off flows? This is why such ridiculous statements in social media often come up “SPY algos are crazy buying for no reason” or “SPY just moved way too much on weak news” etc…

That kind of statement typically shows that people do not pay attention to global asset classes as a whole, to understand why certain moves in the market happen the way they do.

Remember that your asset class of focus does NOT provide always the answers of whats going on in markets, or what the biggest stories are. Often those things happen outside of your focus niche. And many times its very valuable to know why and what is happening as that will eventually impact risk profile for global liquidity.

Many times SPY will rally big time, and it’s not because someone just turns algos up randomly but because key institutions started to push capital in all risk-on assets at the same time. So it is not SPY only that is moving, but the entire chain of risk-on assets, which then feeds into the move of SPY. Tick by tick. One tick-up on bonds leads to one tick-up in SPY. Leads to one tick-up in Russell2000. And then tick by tick one asset class influences the other. Assets are priced on a tick-by-tick basis within the context of what other assets are doing. Always remember that.

Risk-ON November

Do you think it’s random that small-caps had a large amount of multiday runners in November and a relatively good amount of action, at the same time as alt-coints within the crypto space ignited too? And not to mention even OTC stocks started to move in November after being in total hibernation for months if not years. Random? No. Risk-on and a strong one explains it. So no matter what asset class you have selected, you have been impacted by behavior change.

Charts below to highlight point above:

Risk-on November from perspective of big markets:

Risk-on November from perspective of smallcap multiday-runner ignition:

Risk-on November from perspective of big crypto alt-coins:

If you do track multiple markets and asset classes, one can build stronger view on whats happening and why, and always be more inline with reality to those who focus only on single asset class at all times. However, it does take some time to study each asset class at least on the basics before it can be implemented into risk-profile analysis well.

The reason why outlining the “survival aspect” of this analysis is because, if all one has is to speculate why things are moving the way they are (without understanding money flows), that will eventually lead to troubles because it opens up too big room of self-interpretation and subjectivity.

Risk on/off explains what the big guys in markets are doing, where those greenbacks are flowing towards. You can’t see in their head (of those large participants, and their reasons), but you can see into their wallet because the wallet is speaking with the way assets are getting a bid.

Volatility matters

It is not just about the directional moves that matter, but the scale of volatility that adds to a score of risk on/off analysis. High volatile moves of X asset (lets say dollar) add more to the score of risk on/off flows than low volatile move does.

For example move upwards in bond yields could be seen as bearish, but it depends on what magnitude. A high volatile move (using the past 30 days as context) is much more bearish than a low volatile move. This is why one should always have the context of the move in mind to see what kind of contribution it has to the entire bias.

So always have the 30 day and 5 day context in your mind, to understand what kind of magnitude of change in current assets you are observing. Relative volatility and then current change in volatiliy is what matters.

The general rule is, that the more volatile the moves and the more cleanly aligned in the same direction the better. For example, the ideal risk-on ignition version is:

-strongest move in the dollar to the downside in past 30 days

-strongest move in bond yields to the downside in the past 30 days

-strongest move in SPY to the upside in the past 30 days

If all above happens at the same time, that is a high volatility move and all aligned on the risk-ON (all assets agree on same direction). Which is ideal as it doesn’t leave us confused.

Sometimes the movements will not be as clean and one asset class will divert in different direction (for multiple hidden or obvious reasons), for example more confusing risk-on situation (less ideal):

-dollar lower

-bond yields lower

-SPY flat or lower

The above would be an example of a more mixed situation, where one or more asset classes do not agree with risk-on. Especially if the volatility of each asset moves is not big, it’s best to be careful about making any firm conclusions in such case.

In some cycles all assets will agree firmly, which is more often than not. But sometimes there will be more confusing mixture.

To use example of November and context of volatility and why that was such strong risk-on ignition from perspective of bond yields:

Priority of asset classes

Important point to establish, which of those asset classes is most important, or contributes to risk on/off analysis the most? The answer is not static, however there are certain dynamics that usually take place. But sometimes priorities change. It depends on the situation. Overall we could say (and from a personal view) that it’s somewhat equal, but on some days there is one asset that will take a higher lead. This requires a very long explanation to get it right, so just take it as a starting point to consider all key assets listed on article as equal. They are not always equal as said, but to explain those situations historically well it is whole another article in itself. For the starting point, it’s good to balance the input of each asset class into risk on/off analysis as balanced with equal weight.

If one has 5 assets in total, then each represents 20% of the total view. In other words, the meaningfulness of the bond move is equal to SPY. As said, if we were to dig into details it’s not that simple, but roughly speaking it’s the good starting point to use on a daily basis (and then re-calibrate better with more experience).

Some examples of risk on/off ignitions (on ignition day)

Risk-OFF example that established solid intraday reaction with followup over next few days:

Risk-OFF example that established solid intraday reaction with followup over next few days (wrong notation on chart):

Risk-ON example:

Risk-ON example:

Many of the above ignitions are on catalyst days of major news releases, but not all. Because there is so much news on a daily basis hitting the markets it can get very confusing tracking everything and trying to interpret which news article might matter and which might not and the market will ignore it.

It is far better to just focus on risk-profile analysis and then check when flows react strongly. You will know which news event the market had a sensitive reaction to, and it’s likely that this catalyst will impact the market going further. Too many news releases just get ignored by market (short term no market reaction), and can quickly clog market participants with too much noise. Using risk on/off is a filter that helps you with that to isolate news that matter the most.

This makes prioritization of risk profile first, and news interpretation second. Especially since interpreting news is much more difficult often than it is to interpret what the big money is doing and where the flows are going (assets responding will tell the story).

Conclusion

We have highlighted some of the relationships between key assets and how to practically implement them into daily analysis.

What this article does not cover is the basics about what each of those asset classes represents. What is its function, why the global economy needs them, and so forth?

It is expected of the reader that this is studied to make sense of the things said above. For example, why are rising yields bad for the economy and the performance of equities? Why is the rising dollar not ideal for equities or commodities and how that might translate into SPY and so forth?

It is required to study each asset class on its own, cover some ground, and then risk profile analysis will make much more sense. But buckle your seatbelt because it isn’t a quick task especially if you are new to this.

As mentioned in the article above, if one is serious about surviving in the market it is required to study those assets and how they tie in global market flows.

This analysis is what makes one defensive when it’s time to be defensive because the market just went into risk-off.

And it’s this analysis that gives one conviction to step up the risk exposure when risk-on kicks in, by placing more long trades and being more patient (aka greedy) for larger moves.

Source material to study the basics of each asset class is not listed, because there is plenty of free material about this everywhere (if you focus study into each asset class on its own). Just make sure you do not pick subjective opinions when you study. Pick sources from those who strictly talk about the functionality of each asset class, rather than what the assets are supposed to do. Economic books (macro economy) tend to cover this quite well, you can grab bunch in your local library possibly. Your read on risk profile analysis needs to be built on top of objective info, not subjective views. So the focus is functionality when it comes to basics.

235 thoughts on “Risk ON/OFF analysis in markets”

Bwer Company is a top supplier of weighbridge truck scales in Iraq, providing a complete range of solutions for accurate vehicle load measurement. Their services cover every aspect of truck scales, from truck scale installation and maintenance to calibration and repair. Bwer Company offers commercial truck scales, industrial truck scales, and axle weighbridge systems, tailored to meet the demands of heavy-duty applications. Bwer Company’s electronic truck scales and digital truck scales incorporate advanced technology, ensuring precise and reliable measurements. Their heavy-duty truck scales are engineered for rugged environments, making them suitable for industries such as logistics, agriculture, and construction. Whether you’re looking for truck scales for sale, rental, or lease, Bwer Company provides flexible options to match your needs, including truck scale parts, accessories, and software for enhanced performance. As trusted truck scale manufacturers, Bwer Company offers certified truck scale calibration services, ensuring compliance with industry standards. Their services include truck scale inspection, certification, and repair services, supporting the long-term reliability of your truck scale systems. With a team of experts, Bwer Company ensures seamless truck scale installation and maintenance, keeping your operations running smoothly. For more information on truck scale prices, installation costs, or to learn about their range of weighbridge truck scales and other products, visit Bwer Company’s website at bwerpipes.com.

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Unlock exciting rewards with the latest 1xBet promo code! Whether you’re from Bangladesh, Pakistan, India, Nepal, Sri Lanka, Egypt, or the Philippines, you can claim amazing bonuses like free bets, free spins, and welcome bonuses with our updated 1xBet promo codes today. Use your 1xBet promo code for registration to start betting without a deposit or boost your first deposit with extra cash. Enjoy special offers with the 1xBet official promo code, perfect for app users and desktop players. Get your 1xBet free promo code today and experience top-tier betting promotions before they expire! No matter where you are, finding the right 1xBet promo code today means unlocking bigger chances to win, with offers perfectly tailored for players across Bangladesh, Pakistan, India, Nepal, Sri Lanka, Nigeria, Egypt, and the Philippines.

Hey, I think your site might be having browser compatibility issues. When I look at your website in Firefox, it looks fine but when opening in Internet Explorer, it has some overlapping. I just wanted to give you a quick heads up! Other then that, superb blog!

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

bYyyLOlO aWuEBaZ sLN IJhIiiRb vJfsRGpi ezCueGHI vNf

You actually make it seem so easy with your presentation but I find this topic to be actually something which I think I would never understand. It seems too complicated and very broad for me. I am looking forward for your next post, I will try to get the hang of it!

I’m not that much of a online reader to be honest but your blogs really nice, keep it up! I’ll go ahead and bookmark your site to come back down the road. Many thanks

One more issue is that video games are normally serious as the name indicated with the most important focus on knowing things rather than amusement. Although, there’s an entertainment feature to keep the kids engaged, just about every game is often designed to focus on a specific group of skills or area, such as numbers or scientific discipline. Thanks for your write-up.

Nice weblog right here! Also your web site quite a bit up fast! What web host are you the use of? Can I am getting your affiliate link to your host? I wish my site loaded up as fast as yours lol

Generally I don’t learn article on blogs, but I wish to say that this write-up very pressured me to take a look at and do so! Your writing style has been surprised me. Thanks, quite nice article.

F*ckin? amazing things here. I am very glad to see your post. Thanks a lot and i am looking forward to contact you. Will you please drop me a e-mail?

My spouse and I stumbled over here by a different web address and thought I should check things out. I like what I see so now i’m following you. Look forward to looking over your web page again.

One thing I want to say is that often car insurance cancelling is a dreadful experience and if you are doing the correct things being a driver you’ll not get one. A lot of people do are sent the notice that they have been officially dropped by their own insurance company they have to struggle to get added insurance after the cancellation. Low cost auto insurance rates usually are hard to get after the cancellation. Knowing the main reasons pertaining to auto insurance termination can help motorists prevent getting rid of in one of the most critical privileges out there. Thanks for the concepts shared by your blog.

Have you ever thought about creating an e-book or guest authoring on other websites? I have a blog based on the same subjects you discuss and would love to have you share some stories/information. I know my audience would value your work. If you are even remotely interested, feel free to shoot me an email.

F*ckin? remarkable things here. I am very glad to look your article. Thank you a lot and i’m looking forward to contact you. Will you kindly drop me a e-mail?

Have you ever considered about including a little bit more than just your articles? I mean, what you say is fundamental and all. But just imagine if you added some great images or videos to give your posts more, “pop”! Your content is excellent but with pics and video clips, this website could undeniably be one of the very best in its niche. Awesome blog!

Hiya, I am really glad I have found this info. Today bloggers publish only about gossips and net and this is actually annoying. A good site with exciting content, this is what I need. Thanks for keeping this web site, I’ll be visiting it. Do you do newsletters? Can not find it.

Its like you read my thoughts! You seem to understand so much about this, like you wrote the ebook in it or something. I think that you just can do with a few p.c. to force the message house a little bit, however other than that, that is wonderful blog. A fantastic read. I’ll certainly be back.

Hi there, I discovered your site via Google while searching for a similar topic, your web site came up, it appears to be like good. I have bookmarked it in my google bookmarks.

Thanks for another informative web site. The place else may I get that kind of information written in such a perfect approach? I’ve a venture that I am simply now running on, and I’ve been on the glance out for such info.

Your article helped me a lot, is there any more related content? Thanks!

One other thing to point out is that an online business administration training course is designed for college students to be able to easily proceed to bachelor degree programs. The Ninety credit college degree meets the other bachelor education requirements and when you earn your current associate of arts in BA online, you should have access to the most up-to-date technologies in this field. Some reasons why students want to be able to get their associate degree in business is because they are interested in this area and want to have the general training necessary before jumping in to a bachelor education program. Many thanks for the tips you really provide in the blog.

An additional issue is that video games can be serious anyway with the principal focus on studying rather than fun. Although, there’s an entertainment aspect to keep your sons or daughters engaged, every game will likely be designed to develop a specific group of skills or program, such as instructional math or scientific disciplines. Thanks for your write-up.

Howdy, i read your blog occasionally and i own a similar one and i was just wondering if you get a lot of spam comments? If so how do you protect against it, any plugin or anything you can advise? I get so much lately it’s driving me mad so any support is very much appreciated.

Appreciating the time and energy you put into your site and detailed information you offer. It’s good to come across a blog every once in a while that isn’t the same unwanted rehashed information. Fantastic read! I’ve bookmarked your site and I’m including your RSS feeds to my Google account.

Wow! I’m in awe of the author’s writing skills and talent to convey intricate concepts in a straightforward and precise manner. This article is a true gem that merits all the accolades it can get. Thank you so much, author, for offering your wisdom and giving us with such a priceless resource. I’m truly appreciative!

Undeniably believe that which you stated. Your favorite justification appeared to be on the net the simplest thing to be aware of. I say to you, I certainly get irked while people think about worries that they just do not know about. You managed to hit the nail upon the top and defined out the whole thing without having side-effects , people could take a signal. Will likely be back to get more. Thanks

Thanks for the tips about credit repair on this particular web-site. Things i would advice people is always to give up the particular mentality they will buy at this point and pay out later. Like a society most of us tend to make this happen for many issues. This includes holidays, furniture, as well as items we want. However, you should separate the wants from the needs. While you are working to improve your credit rating score you have to make some sacrifices. For example you are able to shop online to save money or you can check out second hand outlets instead of high priced department stores regarding clothing.

I’m amazed by the quality of this content! The author has undoubtedly put a great amount of effort into exploring and structuring the information. It’s refreshing to come across an article that not only offers helpful information but also keeps the readers hooked from start to finish. Great job to him for creating such a remarkable piece!

It is perfect time to make some plans for the future and it’s time to be happy. I’ve read this post and if I could I want to suggest you few interesting things or advice. Maybe you can write next articles referring to this article. I want to read even more things about it!

Thanks for any other informative site. The place else may I get that type of information written in such a perfect approach? I have a project that I’m just now running on, and I have been at the glance out for such info.

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

I’m blown away by the quality of this content! The author has clearly put a tremendous amount of effort into researching and arranging the information. It’s exciting to come across an article that not only gives helpful information but also keeps the readers captivated from start to finish. Kudos to her for producing such a masterpiece!

I’m in awe of the author’s ability to make complex concepts approachable to readers of all backgrounds. This article is a testament to her expertise and passion to providing valuable insights. Thank you, author, for creating such an compelling and insightful piece. It has been an incredible joy to read!

There is noticeably a bundle to find out about this. I assume you made sure good factors in options also.

Greetings crypto heads! Check out a valuable post on latest blockchain insights.

It outlines the key updates in Web3 and DeFi. Super helpful for crypto fans.

Whether you’re a HODLer or day trader, this post will bring some good insight.

Check it out here: https://themerkle.com/how-blockchain-tech-can-make-elearning-more-effective-and-secure/ – Crypto News Worth Reading

check out https://s3.amazonaws.com/photovoltaik-buchloe/unlocking-the-secrets-of-photovoltaik-buchloe-a-complete-guide.html

Hiya, I am really glad I’ve found this information. Today bloggers publish only about gossips and web and this is really irritating. A good blog with exciting content, this is what I need. Thanks for keeping this website, I will be visiting it. Do you do newsletters? Cant find it.

It?s really a nice and useful piece of info. I am satisfied that you simply shared this helpful information with us. Please stay us informed like this. Thanks for sharing.

Greetings crypto heads! Just wanted to share a fresh guide on crypto updates that matter.

It highlights the latest movements in Web3 and DeFi. Packed with useful info.

No matter if you’re into trading, this write-up will bring some good insight.

http://broudestage.wpengine.com/commerce-btc-eth-altcoin-futures-and-options/ – Check this crypto update

Hi everyone! Discovered a valuable post on new trends in digital currencies.

It outlines the major developments in Web3 and DeFi. Super helpful for crypto fans.

No matter if you’re into trading, this write-up will keep you in the loop.

https://aakaashenterprises.com/cryptocurrency-be-taught-and-invest-e-trade/ – Check this crypto update

Greetings crypto heads! I found a very informative guide on crypto updates that matter.

It dives deep into the major developments in BTC, ETH, and altcoins. Definitely worth a read.

If you’re into NFTs, DeFi or just news, this resource will give you an edge.

https://www.estestvenkamak.com/2025/05/26/tips-on-how-to-commerce-crypto-make-a-profit-final/ – Check this crypto update

Hiya very nice site!! Man .. Beautiful .. Wonderful .. I’ll bookmark your blog and take the feeds also?I’m happy to find so many helpful information right here in the put up, we’d like work out more techniques on this regard, thanks for sharing. . . . . .

I think this is among the so much vital info for me. And i’m glad studying your article. However wanna observation on few common issues, The site taste is wonderful, the articles is really nice : D. Just right activity, cheers

Wow! This could be one particular of the most helpful blogs We have ever arrive across on this subject. Actually Great. I’m also an expert in this topic therefore I can understand your effort.

I found your blog web site on google and verify a number of of your early posts. Continue to maintain up the very good operate. I simply additional up your RSS feed to my MSN Information Reader. Seeking ahead to reading extra from you afterward!?

certainly like your website but you need to check the spelling on quite a few of your posts. A number of them are rife with spelling issues and I find it very bothersome to tell the truth nevertheless I will surely come back again.

Hello There. I found your weblog the usage of msn. This is a really neatly written article. I will be sure to bookmark it and return to learn more of your helpful info. Thank you for the post. I will certainly return.

check out https://storage.googleapis.com/restumpingbendigo/restumping-revolution-modernizing-bendigo-properties.html

check out https://s3.ap-south-1.amazonaws.com/restumpingbendigo/ultimate-guide-to-restumping-in-bendigo-everything-you-need-to-know.html

You need to read https://storage.googleapis.com/concretedrivewaysinmelbourne/5-easy-steps-to-upgrade-your-concrete-driveway-in-melbourne.html

I loved as much as you’ll receive carried out right here. The sketch is attractive, your authored material stylish. nonetheless, you command get got an impatience over that you wish be delivering the following. unwell unquestionably come further formerly again as exactly the same nearly very often inside case you shield this hike.

Just read the article and I have to say—really well done. It was super informative, easy to follow, and actually learned a a few things new things. Definitely worth the read!

I’m typically to blogging and i actually appreciate your content. The article has really peaks my interest. I’m going to bookmark your website and keep checking for new information.

Thanks for the suggestions shared in your blog. Something else I would like to say is that weight reduction is not about going on a celebrity diet and trying to reduce as much weight as possible in a few days. The most effective way in losing weight is by acquiring it slowly and obeying some basic points which can make it easier to make the most out of your attempt to shed weight. You may be aware and be following many of these tips, although reinforcing know-how never affects.

Hi there, just became alert to your blog through Google, and found that it’s truly informative. I am gonna watch out for brussels. I will appreciate if you continue this in future. Numerous people will be benefited from your writing. Cheers!

I also believe that mesothelioma is a rare form of cancer that is often found in all those previously familiar with asbestos. Cancerous cells form within the mesothelium, which is a defensive lining that covers a lot of the body’s organs. These cells commonly form from the lining in the lungs, belly, or the sac that really encircles the heart. Thanks for sharing your ideas.

Does your website have a contact page? I’m having a tough time locating it but, I’d like to send you an email. I’ve got some recommendations for your blog you might be interested in hearing. Either way, great blog and I look forward to seeing it expand over time.

Would you be curious about exchanging links?

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me? https://www.binance.com/ru-UA/register?ref=OMM3XK51

Hello There. I found your blog using msn. This is an extremely well written article. I?ll make sure to bookmark it and come back to read more of your useful info. Thanks for the post. I?ll certainly comeback.

I appreciate, cause I found exactly what I was looking for. You’ve ended my four day long hunt! God Bless you man. Have a great day. Bye

Excellent goods from you, man. I’ve understand your stuff previous to and you are just extremely magnificent. I really like what you have acquired here, really like what you are saying and the way in which you say it. You make it enjoyable and you still take care of to keep it smart. I can not wait to read much more from you. This is really a tremendous site.

I?d must check with you here. Which is not one thing I usually do! I get pleasure from reading a put up that will make people think. Additionally, thanks for allowing me to remark!

Nice post. I was checking constantly this blog and I am impressed! Extremely useful information specifically the last part 🙂 I care for such info much. I was looking for this particular info for a very long time. Thank you and good luck.

Its like you read my mind! You appear to know so much about this, like you wrote the book in it or something. I think that you can do with a few pics to drive the message home a bit, but instead of that, this is wonderful blog. A great read. I will certainly be back.

Thanks for the interesting things you have revealed in your article. One thing I would really like to comment on is that FSBO human relationships are built over time. By launching yourself to the owners the first end of the week their FSBO is usually announced, prior to masses start off calling on Wednesday, you create a good link. By mailing them methods, educational products, free accounts, and forms, you become a great ally. Through a personal fascination with them along with their circumstances, you generate a solid interconnection that, on most occasions, pays off when the owners decide to go with a realtor they know as well as trust – preferably you.

affordablecanvaspaintings.com.au is Australia Popular Online 100 percent Handmade Art Store. We deliver Budget Handmade Canvas Paintings, Abstract Art, Oil Paintings, Artwork Sale, Acrylic Wall Art Paintings, Custom Art, Oil Portraits, Pet Paintings, Building Paintings etc. 1000+ Designs To Choose From, Highly Experienced Artists team, Up-to 50 percent OFF SALE and FREE Delivery Australia, Sydney, Melbourne, Brisbane, Adelaide, Hobart and all regional areas. We ship worldwide international locations. Order Online Your Handmade Art Today.

of course like your website however you have to take a look at the spelling on quite a few of your posts. Many of them are rife with spelling issues and I to find it very troublesome to inform the truth then again I?ll definitely come back again.

With havin so much written content do you ever run into any problems of plagorism or copyright infringement? My site has a lot of completely unique content I’ve either created myself or outsourced but it appears a lot of it is popping it up all over the internet without my permission. Do you know any ways to help protect against content from being stolen? I’d genuinely appreciate it.

Great post. I used to be checking continuously this blog and I’m impressed! Extremely useful info particularly the remaining part 🙂 I care for such info a lot. I used to be looking for this certain information for a long time. Thank you and best of luck.

One thing I’d like to reply to is that weightloss program fast is possible by the proper diet and exercise. Your size not just affects appearance, but also the overall quality of life. Self-esteem, melancholy, health risks, and also physical skills are influenced in weight gain. It is possible to just make everything right and still gain. If this happens, a condition may be the primary cause. While an excessive amount food and never enough workout are usually accountable, common health conditions and widely used prescriptions can greatly enhance size. Thanks alot : ) for your post right here.

Howdy! I’m at work surfing around your blog from my new apple iphone! Just wanted to say I love reading your blog and look forward to all your posts! Carry on the great work!

I do not even know how I ended up here, but I thought this post was great. I do not know who you are but certainly you’re going to a famous blogger if you aren’t already 😉 Cheers!

Your point of view caught my eye and was very interesting. Thanks. I have a question for you. binance美國註冊

Hello! Do you know if they make any plugins to protect against hackers? I’m kinda paranoid about losing everything I’ve worked hard on. Any recommendations?

you’re really a good webmaster. The site loading speed is incredible. It seems that you are doing any unique trick. In addition, The contents are masterwork. you have done a excellent job on this topic!

Thanks , I’ve just been looking for information about this topic for ages and yours is the greatest I have discovered till now. But, what about the conclusion? Are you sure about the source?

Currently it looks like Expression Engine is the preferred blogging platform available right now. (from what I’ve read) Is that what you are using on your blog?

Good day! I know this is kinda off topic however I’d figured I’d ask. Would you be interested in trading links or maybe guest writing a blog post or vice-versa? My site covers a lot of the same topics as yours and I think we could greatly benefit from each other. If you might be interested feel free to send me an email. I look forward to hearing from you! Fantastic blog by the way!

Its like you read my mind! You appear to grasp so much approximately this, such as you wrote the e book in it or something. I think that you could do with a few percent to pressure the message home a bit, however instead of that, this is fantastic blog. A fantastic read. I’ll definitely be back.

Thanks for the helpful posting. It is also my opinion that mesothelioma cancer has an incredibly long latency period of time, which means that symptoms of the disease won’t emerge until 30 to 50 years after the preliminary exposure to asbestos. Pleural mesothelioma, which can be the most common form and has effects on the area around the lungs, could potentially cause shortness of breath, breasts pains, plus a persistent cough, which may bring on coughing up body.

I?ve read a few good stuff here. Definitely worth bookmarking for revisiting. I surprise how much effort you put to make such a fantastic informative web site.

Great blog here! Also your website loads up very fast! What host are you using? Can I get your associate link to your host? I want my site loaded up as quickly as yours lol

Its like you read my mind! You appear to understand so much approximately this, like you wrote the book in it or something. I believe that you just can do with some to force the message home a bit, however other than that, this is excellent blog. A great read. I’ll certainly be back.

Thanks for the concepts you have provided here. Also, I believe usually there are some factors which keep your car insurance policy premium lower. One is, to bear in mind buying cars and trucks that are inside good listing of car insurance companies. Cars which are expensive are usually more at risk of being robbed. Aside from that insurance coverage is also using the value of your vehicle, so the higher in price it is, then the higher the premium you spend.

Aw, this was a really nice post. In concept I wish to put in writing like this additionally ? taking time and actual effort to make an excellent article? but what can I say? I procrastinate alot and under no circumstances appear to get something done.

Hello! This post could not be written any better! Reading this post reminds me of my old room mate! He always kept chatting about this. I will forward this page to him. Fairly certain he will have a good read. Many thanks for sharing!

I also believe that mesothelioma cancer is a uncommon form of many forms of cancer that is usually found in those previously familiar with asbestos. Cancerous tissues form in the mesothelium, which is a safety lining that covers most of the body’s areas. These cells typically form in the lining of the lungs, stomach, or the sac that encircles one’s heart. Thanks for expressing your ideas.

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

One thing I would really like to say is that often car insurance cancellations is a dreaded experience so if you’re doing the best things as being a driver you simply won’t get one. A lot of people do get the notice that they have been officially dropped by the insurance company and many have to struggle to get additional insurance after the cancellation. Low-priced auto insurance rates are often hard to get after a cancellation. Understanding the main reasons with regard to auto insurance cancellations can help motorists prevent burning off one of the most important privileges offered. Thanks for the thoughts shared by means of your blog.

I’ve learned many important things via your post. I might also like to express that there may be a situation that you will have a loan and never need a cosigner such as a U.S. Student Aid Loan. However, if you are getting that loan through a traditional loan company then you need to be prepared to have a cosigner ready to make it easier for you. The lenders will probably base their own decision using a few components but the largest will be your credit ratings. There are some loan companies that will also look at your work history and choose based on that but in most cases it will hinge on your score.

Your article helped me a lot, is there any more related content? Thanks!

My coder is trying to persuade me to move to .net from PHP. I have always disliked the idea because of the costs. But he’s tryiong none the less. I’ve been using Movable-type on various websites for about a year and am anxious about switching to another platform. I have heard fantastic things about blogengine.net. Is there a way I can import all my wordpress posts into it? Any kind of help would be really appreciated!

Wonderful items from you, man. I’ve remember your stuff previous to and you’re simply extremely wonderful. I actually like what you’ve obtained right here, certainly like what you are saying and the best way wherein you assert it. You make it entertaining and you still care for to keep it smart. I cant wait to read far more from you. This is actually a tremendous web site.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Thanks for giving your ideas. I would also like to state that video games have been ever before evolving. Today’s technology and improvements have assisted create genuine and fun games. These entertainment video games were not really sensible when the real concept was being attempted. Just like other styles of technology, video games as well have had to grow by way of many many years. This is testimony for the fast progression of video games.

I have discovered that sensible real estate agents everywhere are warming up to FSBO ***********. They are realizing that it’s not only placing a sign post in the front yard. It’s really regarding building relationships with these vendors who sooner or later will become buyers. So, if you give your time and effort to serving these suppliers go it alone : the “Law of Reciprocity” kicks in. Great blog post.

excellent issues altogether, you simply won a logo new reader. What may you suggest in regards to your publish that you made a few days ago? Any positive?

A formidable share, I just given this onto a colleague who was doing somewhat analysis on this. And he in truth bought me breakfast as a result of I discovered it for him.. smile. So let me reword that: Thnx for the treat! But yeah Thnkx for spending the time to debate this, I feel strongly about it and love reading more on this topic. If potential, as you develop into experience, would you thoughts updating your blog with extra particulars? It’s extremely useful for me. Huge thumb up for this blog publish!

**mind vault**

mind vault is a premium cognitive support formula created for adults 45+. It’s thoughtfully designed to help maintain clear thinking

**mindvault**

mindvault is a premium cognitive support formula created for adults 45+. It’s thoughtfully designed to help maintain clear thinking

**glpro**

glpro is a natural dietary supplement designed to promote balanced blood sugar levels and curb sugar cravings.

**sugarmute**

sugarmute is a science-guided nutritional supplement created to help maintain balanced blood sugar while supporting steady energy and mental clarity.

**vitta burn**

vitta burn is a liquid dietary supplement formulated to support healthy weight reduction by increasing metabolic rate, reducing hunger, and promoting fat loss.

**synaptigen**

synaptigen is a next-generation brain support supplement that blends natural nootropics, adaptogens

**glucore**

glucore is a nutritional supplement that is given to patients daily to assist in maintaining healthy blood sugar and metabolic rates.

**prodentim**

prodentim an advanced probiotic formulation designed to support exceptional oral hygiene while fortifying teeth and gums.

I loved as much as you’ll receive carried out right here. The sketch is tasteful, your authored material stylish. nonetheless, you command get bought an impatience over that you wish be delivering the following. unwell unquestionably come further formerly again as exactly the same nearly very often inside case you shield this hike.

**nitric boost**

nitric boost is a dietary formula crafted to enhance vitality and promote overall well-being.

**sleep lean**

sleeplean is a US-trusted, naturally focused nighttime support formula that helps your body burn fat while you rest.

**wildgut**

wildgutis a precision-crafted nutritional blend designed to nurture your dog’s digestive tract.

**mitolyn**

mitolyn a nature-inspired supplement crafted to elevate metabolic activity and support sustainable weight management.

**yu sleep**

yusleep is a gentle, nano-enhanced nightly blend designed to help you drift off quickly, stay asleep longer, and wake feeling clear.

**zencortex**

zencortex contains only the natural ingredients that are effective in supporting incredible hearing naturally.

**breathe**

breathe is a plant-powered tincture crafted to promote lung performance and enhance your breathing quality.

**prostadine**

prostadine is a next-generation prostate support formula designed to help maintain, restore, and enhance optimal male prostate performance.

**pinealxt**

pinealxt is a revolutionary supplement that promotes proper pineal gland function and energy levels to support healthy body function.

**energeia**

energeia is the first and only recipe that targets the root cause of stubborn belly fat and Deadly visceral fat.

**prostabliss**

prostabliss is a carefully developed dietary formula aimed at nurturing prostate vitality and improving urinary comfort.

**boostaro**

boostaro is a specially crafted dietary supplement for men who want to elevate their overall health and vitality.

**potent stream**

potent stream is engineered to promote prostate well-being by counteracting the residue that can build up from hard-water minerals within the urinary tract.

**hepatoburn**

hepatoburn is a premium nutritional formula designed to enhance liver function, boost metabolism, and support natural fat breakdown.

**hepato burn**

hepato burn is a potent, plant-based formula created to promote optimal liver performance and naturally stimulate fat-burning mechanisms.

**flowforce max**

flowforce max delivers a forward-thinking, plant-focused way to support prostate health—while also helping maintain everyday energy, libido, and overall vitality.

**neuro genica**

neuro genica is a dietary supplement formulated to support nerve health and ease discomfort associated with neuropathy.

**cellufend**

cellufend is a natural supplement developed to support balanced blood sugar levels through a blend of botanical extracts and essential nutrients.

**prodentim**

prodentim is a forward-thinking oral wellness blend crafted to nurture and maintain a balanced mouth microbiome.

**revitag**

revitag is a daily skin-support formula created to promote a healthy complexion and visibly diminish the appearance of skin tags.

I’m not sure exactly why but this weblog is loading very slow for me. Is anyone else having this problem or is it a issue on my end? I’ll check back later and see if the problem still exists.

Hey very nice site!! Man .. Excellent .. Amazing .. I will bookmark your web site and take the feeds also?I’m happy to find so many useful information here in the post, we need develop more techniques in this regard, thanks for sharing. . . . . .

My programmer is trying to convince me to move to .net from PHP. I have always disliked the idea because of the expenses. But he’s tryiong none the less. I’ve been using WordPress on several websites for about a year and am concerned about switching to another platform. I have heard excellent things about blogengine.net. Is there a way I can transfer all my wordpress posts into it? Any help would be greatly appreciated!

Can I simply say what a reduction to find someone who really is aware of what theyre speaking about on the internet. You positively know the right way to convey a problem to mild and make it important. More people need to learn this and understand this side of the story. I cant believe youre not more popular because you positively have the gift.

Another thing is that when evaluating a good online electronics store, look for web shops that are frequently updated, maintaining up-to-date with the most recent products, the most beneficial deals, plus helpful information on product or service. This will ensure you are getting through a shop which stays ahead of the competition and gives you what you need to make educated, well-informed electronics acquisitions. Thanks for the vital tips I have really learned from your blog.

I do agree with all of the ideas you have presented in your post. They are very convincing and will certainly work. Still, the posts are too short for novices. Could you please extend them a little from next time? Thanks for the post.

I am so happy to read this. This is the type of manual that needs to be given and not the random misinformation that’s at the other blogs. Appreciate your sharing this greatest doc.